What Are Gravestone Doji Candlesticks and How to Trade Them?

With some cross-checks mentioned above or some specific trading approaches mentioned in the trading strategies, the power of the generated signals could be significantly improved. However, the Gravestone Doji Candlestick should be interpreted in tandem with other indicators and chart patterns to corroborate the bearish trend. The Gravestone Doji is typically viewed as a sign of possible weakness in an uptrend, implying that the bulls are losing control and now the bears are gaining power. It can hint that the price is about to fall, especially if it appears after one long uptrend or near a resistance line.

For this reason, the Gravestone Doji (or any Doji candle, for that matter) should never be taken as a reliable trading signal in isolation. This is particularly true during lower volume trading sessions, where a lone candle can reveal little about overall market sentiment. Trading the gravestone candle pattern is straightforward to understand. As a trend reversal indicator, traders are looking to enter a position when the gravestone candle is completed, and the following candle signals that the market is about to reverse.

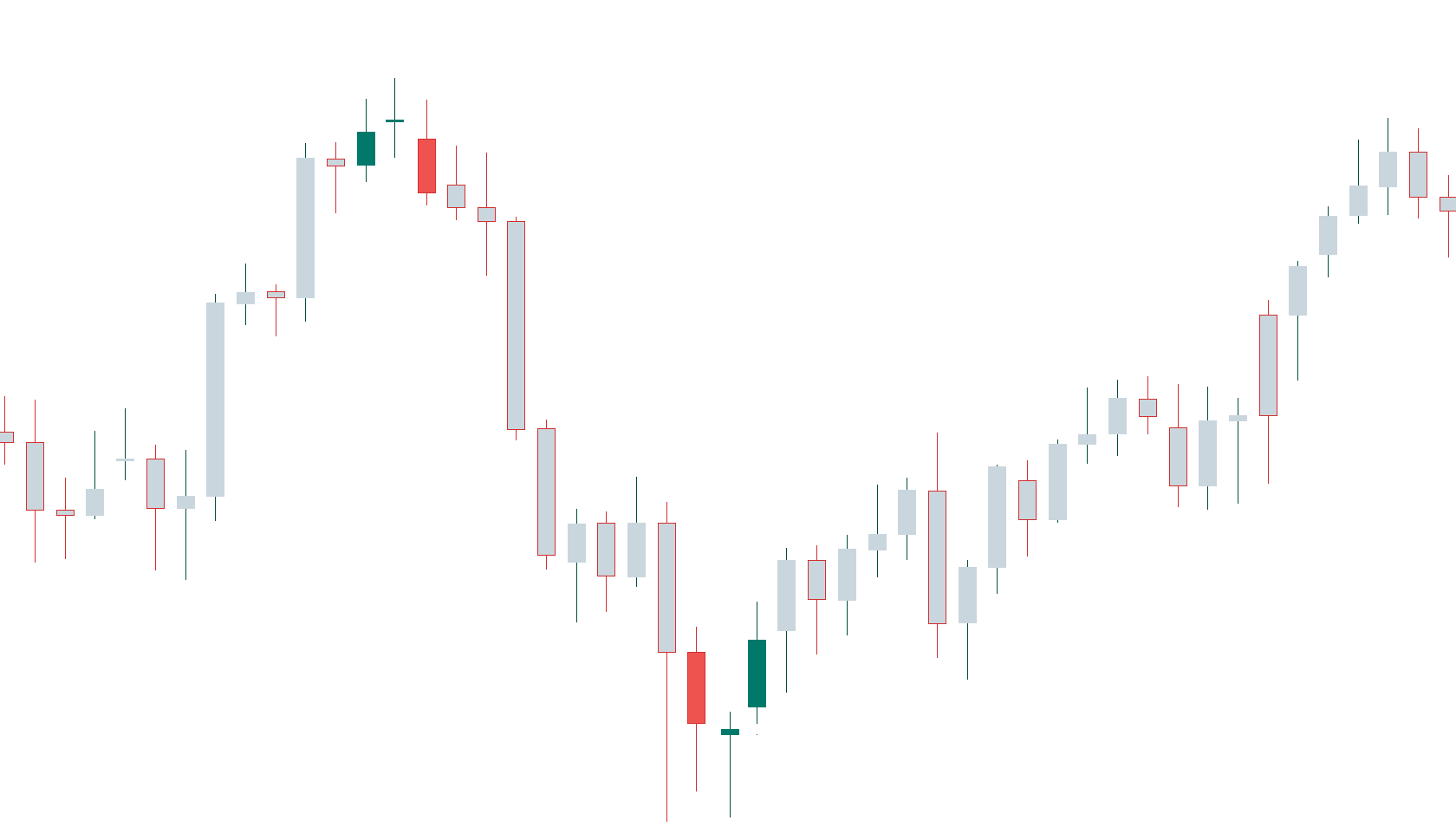

The example below shows how the bearish gravestone Doji forms at the top of a trend and signals a selling opportunity. To confirm the pattern’s bearish reversal signal, we used RSI and MACD – two of the most popular and effective momentum indicators. Although reliability increases with volume and a confirming candle, the gravestone doji is best accompanied by other technical tools to guide trading. Notably, the Doji is a bearish signal if the closing price is below the middle of the candle, especially if it is close to resistance levels. Conversely, if the closing price is above the middle of the candle, it is bullish, as the formation resembles a bullish pin bar pattern. Additional candlestick indicators like engulfing patterns, shooting stars, marubozus, and harami crosses can augment gravestone doji reversals when combined.

Signals and Interpretations

The long upper wick signals that buyers pushed prices higher but ultimately met strong selling pressure that reversed the price back down near the open by the close. There are various types of doji patterns, with names often related to their appearance, such as long-legged doji, dragonfly doji, gravestone doji, and four-price doji. While the gravestone doji can be found at the end of a sag, it’s more common to be found at the end of an uptrend. Although the gravestone doji is popular, it struggles with the very same dependability issues as many visual patterns.

What Is a Doji Candle Pattern, and What Does It Tell You? – Investopedia

What Is a Doji Candle Pattern, and What Does It Tell You?.

Posted: Sat, 25 Mar 2017 23:43:16 GMT [source]

It is primarily determined by the volatility, the range or the wick of the candle, and the volume traded. If the price breaks the resistance, then the trend is likely to continue, and the stop loss will limit losses. This is natural and therefore you should look out for other technical indicators such as RSI and moving averages. The trigger target line is the base of the pattern where the horizontal line formation of the candle appears.

Trading Strategy 1: Gravestone Doji and ADX

Each day we have several live streamers showing you the ropes, and talking the community though the action. What we really care about is helping you, and seeing you succeed as a trader. We want the everyday person to get the kind of training in the stock market we would have wanted when we started out.

- The basic price action behind the inverted hammer is that the buyers have shown their local power and it is a sign at least to be aware of the turnaround.

- The shooting star and the gravestone Doji candle are a single candlestick pattern that indicates a trend reversal and has a similar chart formation.

- Hence, it’s better to confirm the Doji candlestick signal with the help of additional technical indicators.

- If you want a few bones from my Encyclopedia of candlestick charts book, here are three to chew on.

- The open, low, and closing prices can be equal or almost equal for the pattern to be valid.

- A relatively central horizontal line indicates indecision, with traders unwilling to take a bullish or bearish position either way.

Typically, traders use this pattern to enter a short-selling position or exit an existing long position. As expected, the bearish gravestone Doji candle pattern appears at the top of an uptrend and indicates that the market trend is about to change. As noted above, a gravestone doji is used in technical analysis. They rely on statistical trends, such as past performance, price history, and trading volume to make their trading decisions. They often employ charts and other tools to identify opportunities in the market. Conversely, when the market has shown an upward trend before, a dragonfly doji might signal a price drop, known as a bearish dragonfly.

Are you ready to become financially independent by learning how to trade?

On the contrary, the trend reversals are usually heavily anticipated and traders are looking for the start of the movement in the opposite direction. Also, many traders overview various markets, looking for turnaround point because such scenarios offer high risk-reward ratios which is a key aspect of risk management. The Dragonfly Doji is established when a trading period’s open, close, and high are approximately at the same price level, with a long lower shadow and little or no upper shadow. This pattern suggests that sellers originally tried to drive the price down but, after a while, lost control, with buyers forcing the price back up to near the open. The lack of an upper shadow suggests that there was minimal or no inertia from sellers during the session.

Thus, the dragonfly doji is not a highly reliable indicator of price reversals. Even with the confirmation candlestick, it is not guaranteed that the price will continue the trend. Typically, a dragonfly doji with a higher volume is more reliable than one with a lower volume. This gravestone doji reversal signaled the end of Bitcoin’s meteoric bull run and preceded a long bear market.

As you can see in the chart above, the Gravestone Doji chart pattern appears at the bottom of a downward trend and signals the end of the bullish sentiment. Further, when trading the bearish gravestone candle pattern, a stop loss should be placed above the highest level of the gravestone candle. Further, as explained above, the gravestone candlestick pattern can be either bullish or bearish, meaning you’ll have to know how to identify this pattern in both market scenarios. Then, as soon as the next candle closes below the closing price of the gravestone candle, a trend reversal is likely to occur, and a new bearish trend begins. As you can see in the GBP/USD 1H chart above, the gravestone Doji appears at the end of an uptrend with pretty much the same opening price and closing price and a long upper shadow. Either way, the gravestone Doji candle is a trend reversal pattern you must know.

Limitations Of Gravestone Doji

Traders need to use other technical indicators or patterns to identify the proper time for an exit. They usually create orders right after the confirmation candlestick appears. A trader can long a stop loss below the low of a bullish dragonfly or short a stop loss above the high of a bearish dragonfly. When the price of a security has shown a downward trend, it might signal an upcoming price increase. If the candlestick right after the bullish dragonfly rises and closes at a higher price, the price reversal is confirmed, and trading decisions can be made.

If you can’t read the price action, it will cause you many headaches. Technical analysis also comes into play and is an important part of a gravestone doji candlestick pattern. The term gravestone doji refers to a bearish indicator commonly used in trading by technical analysts. A gravestone doji is a bearish reversal candlestick pattern that is formed when the open, low, and closing prices are all near each other with a long upper shadow. The long upper shadow suggests that the bullish advance at the beginning of the session was overcome by bears by the end of the session. A gravestone doji is a candlestick pattern that signals potential trend reversals.

The Doji candlestick, also called a Doji star, shows indecision between buyers and sellers in the crypto market. This type of candlestick is confirmed on a technical analysis chart when the opening and closing prices are almost identical. Its open price and the close and low gravestone doji candle of the day are all pretty much near each other. In addition to the reliability concern, another limitation of the doji pattern is that it cannot provide price targets. It is difficult to estimate the return of a trade that is made according to pure dragonfly doji analysis.

The gravestone Doji is characterized by a long shadow which indicates a higher intraday price range. Candlestick charts have been used in Japan since the early 18th century much before the modern stock exchanges were established. Feel free to ask questions of other members of our trading community.

- With the knowledge from this complete gravestone doji guide, you have an advantage.

- We recommend that you split the day into two or three halves, and see how the pattern performs on each.

- This gravestone doji reversal signaled the end of Bitcoin’s meteoric bull run and preceded a long bear market.

In this guide, we’ll cover what the Gravestone Doji is, how you can identify it, and what kind of market information you can find out from it. This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. The US dollar was gaining ground and was getting stronger against the Yen. However, after the 17th of September, the trend changed, and the pattern reversed.

How to Practice the Gravestone Doji

The pattern forms when the power dynamics between the bulls and the bears change. Before the pattern, the bulls are more active and push the price upwards. Candlestick charts are made up of candles, with a body of the candle and a wick of the candle. We don’t care what your motivation is to get training in the stock market. If it’s money and wealth for material things, money to travel and build memories, or paying for your child’s education, it’s all good.

If we look at the price pattern for the USD/JPY, somewhere around 17th September 2019, a Graveyard Doji pattern seems to be forming. They help in the better visual representation of the data than the simple https://g-markets.net/ line charts. Our content is packed with the essential knowledge that’s needed to help you to become a successful trader. We have members that come from all walks of life and from all over the world.

دیدگاه خود را ثبت کنید

تمایل دارید در گفتگوها شرکت کنید؟در گفتگو ها شرکت کنید.