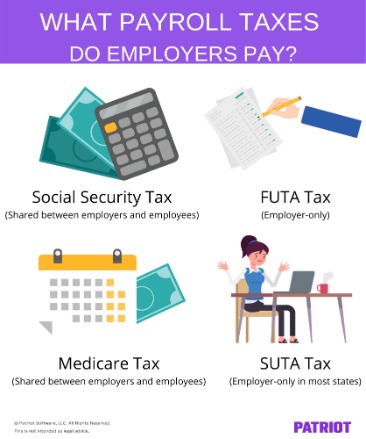

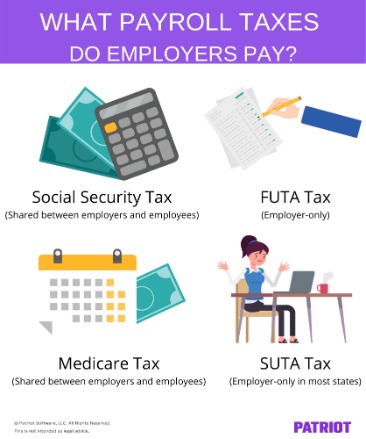

The precise tax treatment and other restrictions on directors remuneration may depend on both the country or state concerned, and on the legal structure of the business. Distinctions that can be important include whether or not the director is also a shareholder in the company, whether or not the director is performing other professional duties for the company such as acting in a direct management role. It may also make a difference whether or not the remuneration is entirely fixed or dependent on the performance of the company. One of the more complicated elements of directors’ remuneration is that it is made up of many different elements compared with ordinary employees. Often a basic salary is topped up with benefits such as healthcare insurance or retirement benefit plans. There can also be bonuses based on the company’s performance, payment in shares, or payment in the form of share options that allow the director to buy shares from the company at a fixed price that may be sold on the open market at a profit.

James Gunn, Mark Hamill, and More Pay Tribute to Late Marvel … – Inside the Magic

James Gunn, Mark Hamill, and More Pay Tribute to Late Marvel ….

Posted: Sun, 03 Sep 2023 23:50:09 GMT [source]

On the long-term share incentive plans, the Board has decided that the results of all years will be measured, but no shares can be earned in 2022 and 2023. Thus, the maximum number of shares the members of the Fortum Leadership Team can earn will be cut to 1/3 or 2/3 in accordance with the remuneration restriction. This leads to an outcome of 9% of the pre-restriction maximum in the 2020–2022 plan, with delivery scheduled for the spring of 2024.

How Much Should You Be Paid as a Board Director?

Disclosure of directors remuneration is increasingly regarded as good practice and is now mandated in several countries. Some jurisdictions call for disclosure of remuneration of a certain number of the highest paid executives, while in others it is confined to specified positions. The CMA requires that the remuneration policy especially of executive directors should include an element that is linked to corporate performance. When preparing its proposal, the committee considers, among other things, the development of director remuneration and the level of director remuneration in peer companies. The committee has underlined the importance of aligning the interests of directors with those of shareholders and prefers payment of board remuneration in the form of shares.

The Board of Directors regularly reviews the performance of the President and CEO and other Fortum Leadership Team members. Fortum’s LTI programme consists of the annually commencing LTI plans with a three-year performance period. The relative TSR measured against a peer group of European utilities, has been the financial target in the LTI programme since 2019.

What Is Directors’ Remuneration?

According to the purchase order issued by the Company, the shares were purchased within two (2) weeks following the release of the Company’s Interim Report for the period 1 January – 31 March 2022. Our advisers act on domestic and international projects of all shapes and sizes, working with many of the leading names in the market. Browse our experience below, or use the filters to look-up recent work in particular geographies and industry sectors. Members of the Fortum Leadership Team outside Finland participate in pension systems based on statutory pension arrangements and market practices in their local countries. In addition to the statutory pensions, the members of the Fortum Leadership Team have supplementary pension arrangements.

1) The amounts stated in the table also include the fixed annual fees paid in January-March 2022 based on the resolutions of the 2021 Annual General Meeting. In line with the Solidium bridge financing facility with the Finnish State, the fees to be paid to the Board of Directors will not be increased in 2022 (as of the signing date of the agreement) and 2023. As such the bridge financing agreement is no longer valid since Fortum has paid the tranche drawn in full.

Directors, that are members of the board of directors, are senior managers who act for shareholders to supervise or control company affairs. Historically, the duties of directors have undergone a process of development and evolution. Before the 1870s and 1880s, in the early joint-stock companies, directors were those who represented shareholders to manage and supervise the operation of the company. The special decree passed by the British Parliament in 1844 clearly stated that the director is the person who directs, handles and supervises the affairs of the company. After the Second World War, the management function of the board of directors gradually faded and became a leading and supervisory agency.

Short-term performance-linked remuneration

In addition to the short-term incentive programme, other variable reward mechanisms can be used in limited, precisely defined cases. 1) In accordance with the Solidium bridge financing facility with the Finnish state, the STI earned in 2022 was not paid. 2) President and CEO Markus Rauramo has decided to waive the LTI rewards from the 2020–2022 and the 2021–2023 LTI plans, thus no LTI rewards shall be paid to Markus Rauramo in 2024.

Upon the recommendation of the Nomination and Remuneration Committee, the Board of Directors approves annually the compensation of the President and CEO within the confines of the Remuneration Policy for the President and CEO. The composition and duties of the Nomination and Remuneration Committee have been described in detail in the Corporate Governance Statement. In order to avoid any conflicts of interest, the Nomination and Remuneration Committee shall consist of non-executive members only.

Annual Report on Remuneration of the Directors of listed corporations

In 2021, President and CEO Markus Rauramo had one joint Fortum Executive Management (FEM) target related to the progress in strategic priorities, and one individual target related to the co-operation with Uniper. The individual target was related to the progress in the strategic cooperation areas (Nordic hydro and physical trading optimisation, wind and solar, and hydrogen) and the progress in value creation and strategic portfolio development. The STI outcome of these joint FEM targets and the individual targets reached 64% of the maximum. According to the terms of the arrangement, fixed salaries of the Fortum Leadership Team will not be increased in 2022 and 2023, nor will members of the Leadership Team receive short or long-term performance bonuses for those years. Fortum published the Remuneration Report for the company’s governing bodies for 2022 on its website on 3 March 2023, and it was presented to the Annual General Meeting of Fortum held on 13 April 2023 in accordance with the Finnish Companies Act. After the meeting, Fortum’s new Board reassessed the implementation of the remuneration restrictions imposed by the Bridge financing agreement with the Finnish State last autumn and changed the interpretation made by the previous Board of Directors.

- The regression showed that the regression equation passed the F test at a significance level of 0.1%, and the model goodness of fit reached 81.34%, indicating that the model has strong explanatory power (see Table 5).

- The amount paid annually to the Personnel Fund is based on the achievement of the annual targets.

- The annual base fee will be paid in the company shares and cash so that approximately 40% of the fee will be paid in the company shares to be purchased on the Board members’ behalf, and the rest in cash.

- And the company’s industry is used as an instrumental variable for directors’ remuneration.

The degree of achievement of the target values shall be used as a common evaluation index for all directors. Individual evaluations shall be conducted according to each director’s area of responsibility. The amount of bonuses shall be calculated based on a variable payment rate of 0% to 200% and the bonuses shall be paid at a fixed time each year. As regards restricted stock remuneration, the Company shall, in principle, allot shares of the Company’s common stock every year, after concluding an agreement on allotting restricted stock between the Company and each director (excluding Audit & Supervisory members and outside directors). The number of shares of restricted stock to be allotted shall be determined based on the position of the allottee.

Whether the directors put forward negative opinions on the board meeting for a period of time is used as an instrumental variable for whether the directors put forward negative opinions on the board meeting. And the company’s industry is used as an instrumental variable for directors’ remuneration. Through analysis, it is found that after controlling endogeneity, the conclusion of this paper is still robust (see Table 6).

In addition, each member will be paid EUR 750 per meeting of the Board attended, the Chair’s meeting fee being double this amount. Lastly, in order to avoid conflicts of interests for remuneration consultants, it requires that consultants who advise the remuneration committee must not also advise other departments of the company. As a last resort, companies should reclaim variable components of remuneration which were paid on the basis of data which later proves to be manifestly misstated. The Board of Directors approves the participation of the Fortum Leadership Team members in each annually commencing LTI plan. Subject to a decision by the Board of Directors the President and CEO is authorised to decide on individual participants and potential maximum awards for other participants than the Fortum Leadership Team in accordance with the nomination guidelines approved by the Board of Directors.

President and CEO Markus Rauramo has decided to waive the LTI reward from the 2020–2022 LTI plan, thus no LTI reward shall be paid to Markus Rauramo in 2024. In 2022, President and CEO Markus Rauramo had two joint FEM targets and one individual target. These targets related to the structural changes in Fortum Group, various strategic projects and the review of Fortum Group strategy. The earned incentives for the year 2021 were paid in April 2022 based on the decision by the Board of Directors made in March 2022. Whilst people pursue board appointments for a wide range of reasons it is useful to know how much you might get paid. For many, you will soon recognise that a board appointment is not the financial gold mine you might have thought it would be.

There can be an inherent legal restriction in that directors are required to act in the best interests of the company. If the company is in financial difficulties, excessively high levels of directors’ remuneration could be considered a violation of this restriction. In listed companies, independent directors are not the only supervisors, in fact all directors are supervisors. At present, the supervision duties of independent directors are more emphasized in listed companies, while the supervision ethics and independence duties of non-independent directors or internal directors are ignored. Board remuneration in 2021The Annual General Meeting 2021 resolved that the Chair of the Board be paid an annual base fee of EUR 195,000, the Deputy Chair of the Board EUR 140,000 and other members of the Board EUR 115,000. The annual base fee will be paid in the company shares and cash so that approximately 40% of the fee will be paid in the company shares to be purchased on the Board members’ behalf, and the rest in cash.